From Beginning

At Patel Web Solution, we offer a specialized TallyPrime with GST course in Ahmedabad designed to equip students and professionals with practical knowledge of business accounting, GST compliance, and advanced Tally features. Whether you're managing a small business or working as a finance professional, our course provides everything you need to streamline your accounting operations using TallyPrime.

TallyPrime is a powerful business management software that simplifies accounting, inventory handling, and financial reporting. When integrated with GST (Goods and Services Tax) features, it becomes a complete solution for businesses aiming to automate tax calculations, generate compliant invoices, and file returns accurately.

GST Setup & Configuration

GST Billing & Invoicing

GST Return Filing

GST Reconciliation & Audit

E-Way Bill Management

Payment Tracking & ITC Adjustments

Multi-Tax Support & Inventory Management

With our TallyPrime with GST course, you’ll gain the confidence and competence to handle accounting and taxation tasks efficiently. Whether you are starting your career or upgrading your skills, Patel Web Solution is your go-to institute for professional growth in Ahmedabad.

Visit us or contact us today to learn more and book your free demo class!

GST : GST Setting, Bill With GST, SGST, CGST, IGST, Goods & Services

Yes, Sure. You can attend a Free Demo Lecture.

Yes, We will Provide ISO 9001:2015, Government Approved Certificate.

Yes, you Can Pay your Fees in EMI options.

Yes, you will get a good Discount in One Short Payment Option.

Yes,our 50% students are from Non IT Background.

Yes, 100%. We have our own Job Placement Consultancy – My Job Placement.

Yes, we are providing FREE Spoken English Sessions, Interview Preparation & Mock Round for Interviews.

Yes Sure, We arrange Our Batches according College Students & Working Professionals.

As per our standard Rules, We have decided a fix duration for every courses. But if any student requires a few more time then no problem.

Yes, We are providing 15/45 Days Internship & 3 to 12 Months Internship also we are providing with Live Project Training & Job Placement.

Answer: TallyPrime is an advanced business management software used for accounting, inventory management, payroll, and tax compliance. It provides features like invoicing, reporting, and GST compliance, catering to businesses of all sizes.

Some key features include:

TallyPrime supports transactions like:

TallyPrime provides pre-configured reports like GSTR-1 and GSTR-3B. You can:

HSN (Harmonized System of Nomenclature) and SAC (Service Accounting Code) are used for categorizing goods and services under GST. In TallyPrime, these codes are linked to items and services for correct tax calculation and GST compliance.

Answer: TallyPrime tracks input GST paid on purchases and offsets it against output GST liability. It automatically adjusts ITC in GST returns, ensuring accurate tax payments.

Answer: Use the GSTR-2A Reconciliation report to identify mismatches. Possible actions include:

TallyPrime allows users to configure GST for each state separately. It supports multi-location inventory and ensures that the correct GST type (CGST/SGST/IGST) is applied based on the source and destination.

Flexible supported learning

Flexible supported learning

Apart from technical training in various Website Development, Application Development & Software Development , Patel Web Solution helps you get a foothold I booming IT Industry. 100% Placement Assistance a student completes his / her course successfully. Patel Web Solution Dedicated Placement Cell helps him/her interview with major companies in job roles like programmer, web developer, software tester, database analyst & many more.

Land your dream job at one of the leading tech companies

We believe in quality

Patel web solution exceeded my

expectations with their

comprehensive Power Bi course.

Every aspect was covered in

detail. Patel Web Solution are

highly knowledgeable and

approachable, always ready to

provide guidance and support.

My trainers are motivating and

inspiring me to move forward

for every step. I'm on the way to

my "developer" career. Thanks

for the supportive service. I'll

surely suggest PWS to all my

friends.

Master of Computer Application (MCA) - RB Institute of Management Studies

I'm Dhruvi Parekh. I enrolled in

Web Development Course here.

It was really really good

experience and learned a lots of

new things here, faculty was also

good and friendly too. Overall it

was really nice here in Patel

Web Solutions and I would

really recommend to visit here

Diploma in Computer Engineering. - Monark University

I took a Full Stack Development

programming course at Patel

Web Solution, and it was

fantastic. The instructor was

very clear and thorough,

explaining complex concepts in

simple terms. The course had a

lot of practical exercises, which

helped me build a strong

understanding of the language.

The institute offered great

support, including career

counseling and resume-building

workshops. I now feel confident

in applying for Full Stack

Development roles, and I have

already landed my first job with

the help of job placement done

by Patel Web Solution.

Bachelor of Computer Application(BCA) - Monark University

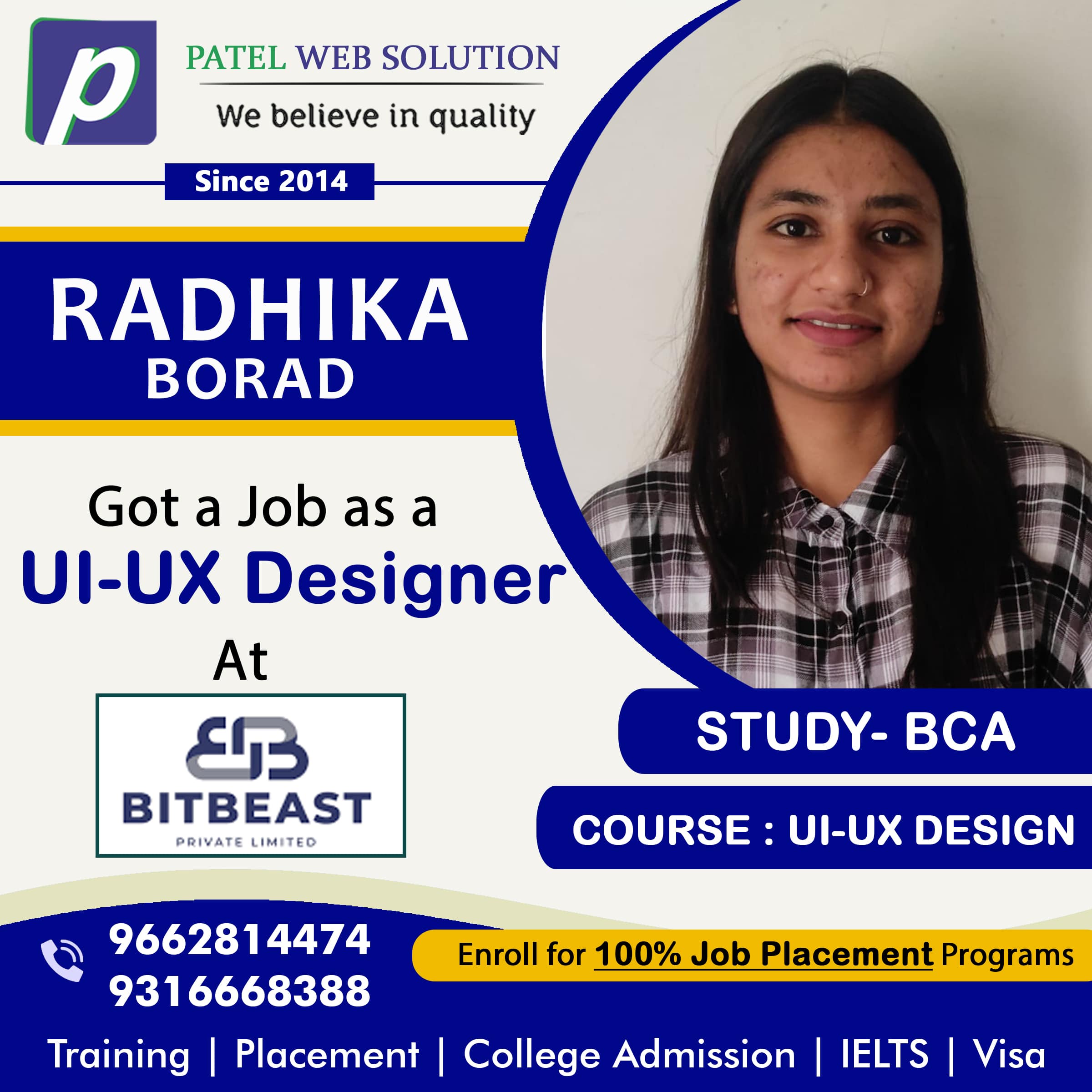

My name is Radhika Borad. I

have learn coreldraw softwere

here. My experience was

amazing, this course gave me a

head start to my career. I got

access to an amazing community

where people uplift each other

and grow together. It is carefully

curated to help you throughout

your journey. It's a once in a

lifetime experience and I'll

forever be grateful. And I also

get my job placement Support so

I suggest to all please must visit

Patel Web Solution.

Bachelor of Computer Application (BCA) - KSN kansagara Mahila College, Rajkot

I am so grateful and thankful to

Heena Maam & Manushree

Maam for helping me to learn

Adobe Illustrator in very efficient

way . You guide me so well

thank you for giving me this

opportunity in IT field I have got

placement in a very good

company from Patel Web

Solution and I am very happy

with my job and in future I can

make my career in this job.

Thanks a lot to PWS and my

trainers for the continuous

support and concern.

Diploma in Computer Engineering - Apollo Institute of Engineering and

Technology

Learning from Patel Web

Solution has transformed my

skills to a big extent. When I

joined C,C++ & Web Design

course, I had zero skills. But

now I am happy that I am

knowledgeable to develop

innovative websites. Thanks to

the entire team of Patel Web

Solution for their constant

support.I really appreciate

Bachelors in Vocational in Information and

Bachelor of Commerce(B.com) - JG University

Hello my name is Priyanka

Mangroliya. I recently

completed React Native Course

at Patel Web Solution. I had

best experience during my

training. The trainer is really

good and explained me with

many real-time examples. The

institution has very good in

infrastructure and also good for

studying. I will surely

recommend this institute if u

want to improve your personal

skills and knowledge.

Bachelors in Vocational in Information and

Bachelor of Commerce(B.com) - R.K Vaghasiya Commerce College

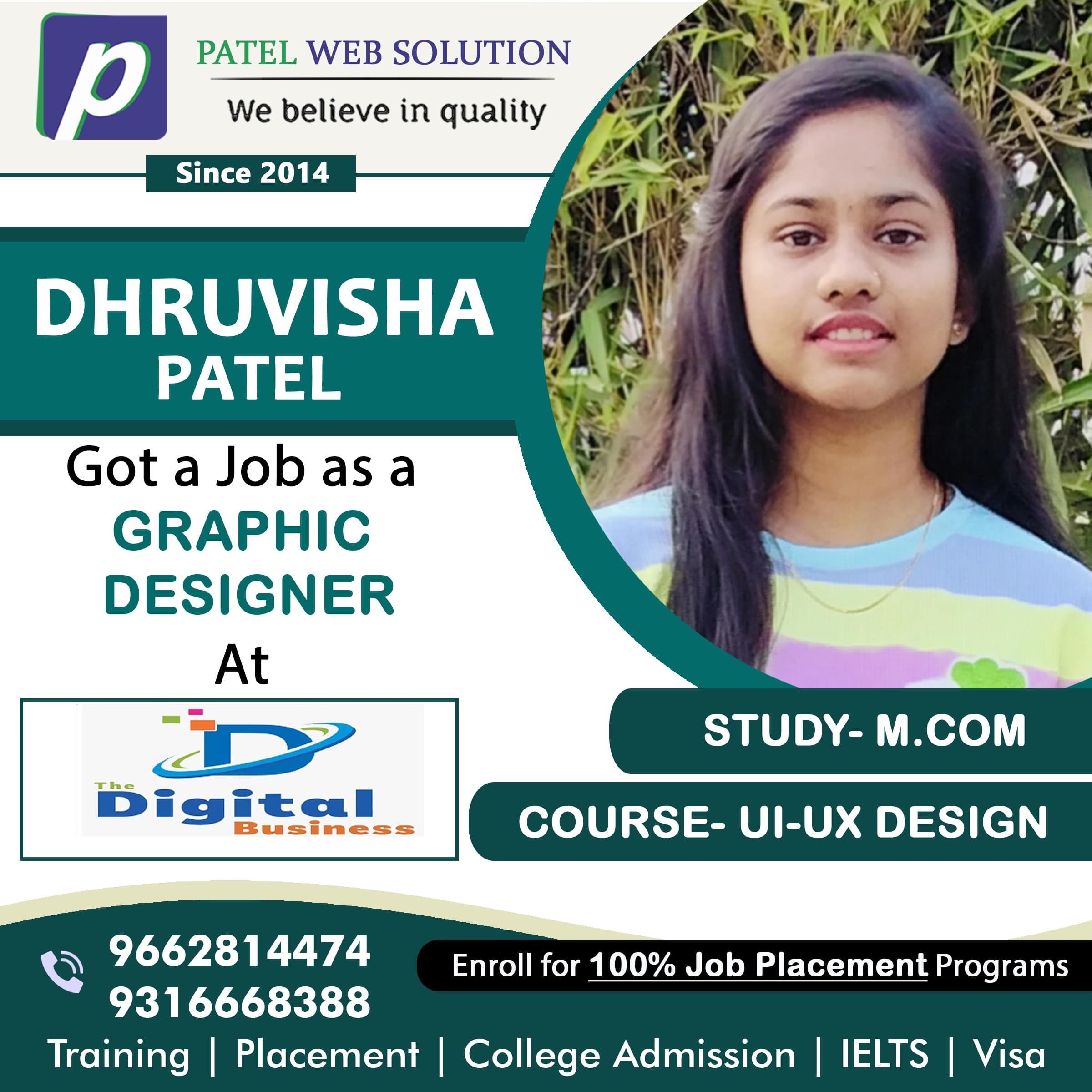

I have completed Ui/Ux Course

here. Institute is a top-notch

service that offers affordable and

high-quality education. The

institute provides support and

guidance, and offers career

insights and portfolio

preparation sessions class and

environment. They teach like

real life experience and things.

My confidence and my

personality totally changed. One

best thing is Free interview skills

for all..so guys please visit Patel

Web Solution for making your

future brighter with learning best

Industry level Courses.

Bachelors in Vocational in Information and

achelor of Commerce(B.com) - Shree Sahjanand Arts & Commerce

College

Completing Web Development

with Patel Web Solution was a

wonderful experience. Under

their guidance, I delved into

various aspects of web

development, from HTML and

CSS to JavaScript and beyond.

The hands-on projects allowed

me to apply theoretical

knowledge to real-world

scenarios, honing my skills and

boosting my confidence. A good

place to grow and build a

network.

Bachelors in Vocational in Information and

Technology (MCA) - Silver Oak University

I highly recommend Patel Web

Solution for their comprehensive

IT courses. Their React

JS course covered everything

from HTML to Bootstrap and

beyond. The teaching was

excellent, and I gained valuable

industry-related experience. The

interview preparation classes

were also incredibly helpful. If

you're looking for a reliable

place to learn IT skills, Patel

Web Solution is the way to go!

Master of Computer Application (MCA) - RB Institute of Management Studies

I just completed my internship

in Web Design Course with

Python(django). Gain the

industry level knowledge. An

enriching experience with top-

tier faculty and excellent

learning resources. The campus

is welcoming, and the

opportunities for growth are

endless.Overall a very

informative training session.

Course content got well

covered and also demonstrated

the concept very well. Thanks

for such an informative and

concept-clearing training

session.

B-tech - Indus University

Patel Web Solution is a Best

Company for IT training. I

learnt C,C++, Web Design, Php

& WordPress. The professors

are experts in their fields and are

always available to help

students. The curriculum is

rigorous but engaging, and the

hands-on learning opportunities,

such as internships and projects,

have been invaluable. The

campus is beautiful, with

modern facilities and plenty of

study spaces. I feel prepared for

my career, and I highly

recommend this institute to

anyone looking for a quality

education.

12th Commerce - Jai Hind Vidhyalaya

I chose Flutter training in Patel

Web Solution . The trainer is

really good and explained me

with many real-time examples.

The institution has very good in

infrastructure and also good for

studying. I will surely

recommend this institute if u

want to improve your personal

skills and knowledge. The

institute was very helpful in

understanding my need and

accommodating it. Thanks for

the training.

Bachelor of Computer Application (BCA) - Silver Oak university

I recently attended the Spoken

English course at Patel Web

Solution, and I had an amazing

experience! The instructors

were knowledgeable,

supportive, and helped me to

improve my English speaking

skills significantly. The course

was well-structured, and the

atmosphere was friendly and

encouraging.I highly

recommend Patel Web Solution

to anyone looking to improve

their Spoken English skills. The

institute truly delivers on its

promise, and I'm grateful for

the experience

12th Science - Pooja Vidhyalaya

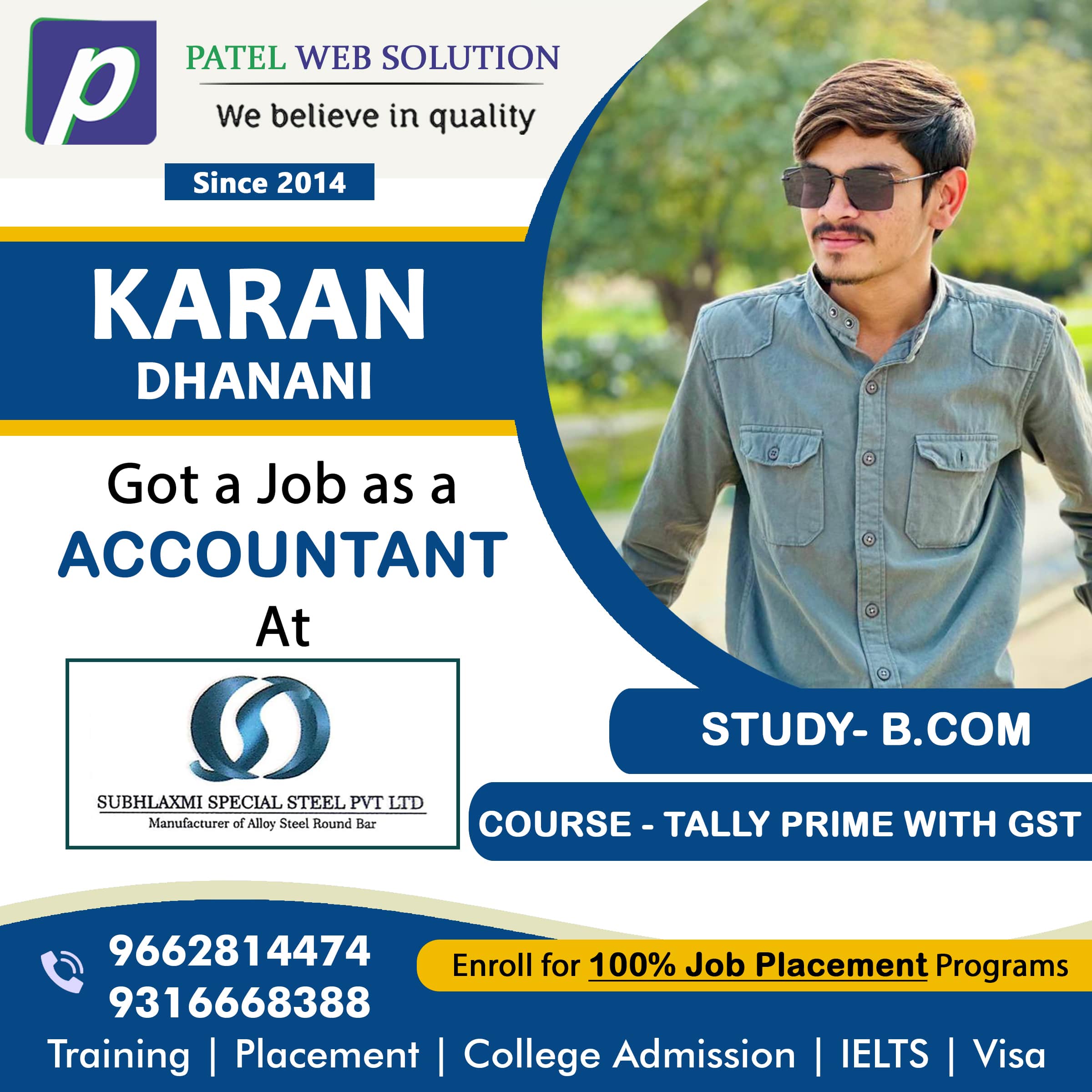

I recently completed the Tally

classes and the CCC course,

and I'm thoroughly impressed

with both. The Tally classes

were incredibly detailed and

well-structured, providing a

solid foundation in accounting,

GST, and financial

management software. The

instructors were highly

knowledgeable and ensured that

all concepts were clearly

explained, making it easy to

grasp even for beginners.

BBA (HONS) - GLS University

5 I have completed Front End

Development Course. Very

knowledgeable faculty and

good facilities here from the

fundamentals to advanced

strategy every aspect was

covered in detail. I would

personally recommend to all to

join Patel Web Solution for

learning best IT courses. The

course helped me to build

confidence, Valuable

experiences and learning.

B.E (IT) - Sabar Institute of Technology for Girls

Hello, my name is Happy Patel.

I recently completed Full

Stack-Development Course at

Patel Web solution. I had the

best experience during my

training. Attending this institute

was a life-changing decision for

me. I came in unsure of my

career path, but thanks to the

mentorship and opportunities

provided by the faculty, I

gained confidence and clarity.

The networking opportunities

have been incredible, and I now

have a solid foundation for my

career. Provide personal

attention for each student was

remarkable point. So as per my

whole experience I strongly

recommend to you all to must

visit Patel Web Solution for

your development in IT

Industry.

Pursuing B.voc IT - Silver Oak University

My Name Patel Dharmik .I

learnt C language and CCC

Course here. The course

structure was well-defined and

each and every topic was deeply

covered. I also received

personalized attention from

Patel Web Solution I must

request to you all please to visit

Patel Web Solution for learning

best computer courses.

12th pass (Commerce) - Silver Oak University

Hi, I'm Arpit, and I recently

completed the PHP Web

Development course at Patel

Web Solution. The course was

well-structured, and the

teaching methods were

engaging. The instructors were

knowledgeable and supportive.

The course covered topics from

basics to advanced, including

Php particularly enjoyed the

project-based learning

approach, which helped me to

build a strong portfolio

Bachelor of Computer Application (BCA) - S.V Vanijya Mahavidhyalaya

My time at Patel Web Solution

has truly been life-changing.

The professors are not only

experts in their fields but also

genuinely care about the

success of their students. The

learning environment is

collaborative, and the campus

is vibrant with plenty of

extracurricular activities. The

institute encourages personal

growth, and I’ve made lifelong

friendships here. It’s been a

wonderful experience, and I

highly recommend this institute

to anyone looking to advance

their education and career..

B.tech in Computer Engineering - Monark University